Angie Best, the ex-wife of footballing legend George Best, has been diagnosed with “advanced” colon cancer. It has also spread to her liver, her son Calum has shared.

Overnight, Calum posted a reel to social media, announcing the news. As a result, he has now set up a GoFundMe page to help pay for treatment. His cousin, EastEnders legend Samantha Womack, has reshared it, asking her followers to help.

Posting on Twitter, Samantha said: “After surviving my own cancer, I am devastated that my auntie Angie has advanced colon and liver cancer. Calum and I are doing everything we can, but we really need support. Appreciate any help you can give.”

Samantha’s father Noel, who took his own life in 2009, aged 60, was Angie Best’s brother.

The soap star was told that she had breast cancer in August 2022. In December of that same year, after undergoing gruelling treatment, she was declared cancer-free.

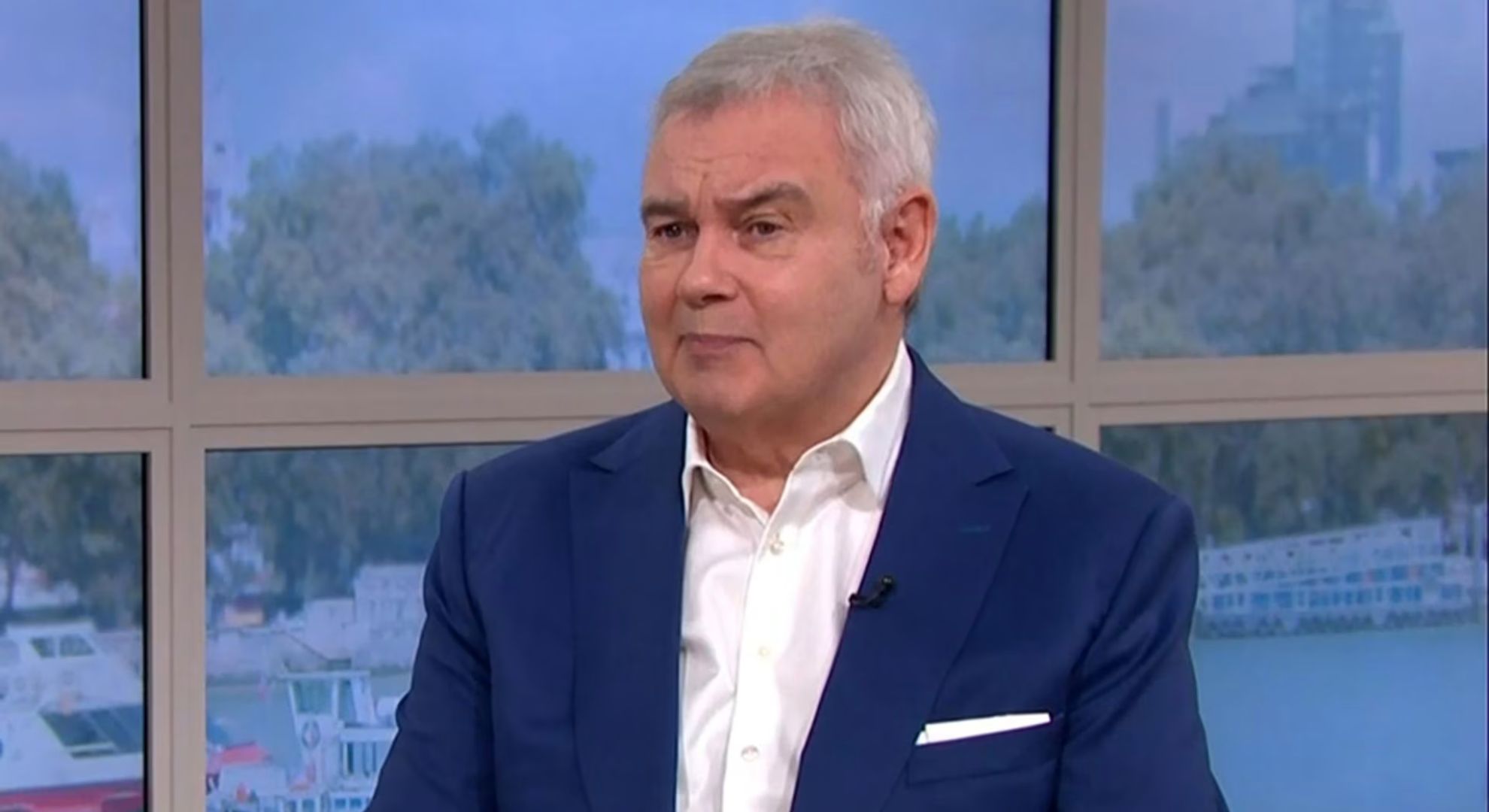

EastEnders icon Samantha Womack has shared Calum’s plea for financial help (Credit: Splash News)

Angie Best diagnosed with cancer

Posting on the fundraising page, and on his social media, Calum shared: “Hi everyone. I’ve been thinking long and hard over the past few weeks about how to write this. I wanted to get the words right, but when it comes to health, and when it comes to my mum, the only thing that really matters is honesty.

“A few weeks ago, my beautiful, wonderful mum was diagnosed with cancer.”

He added: “For as long as I can remember, she has lived her life rooted in health, fitness and wellbeing. She has always believed in taking care of the body, mind and soul. But as we all know, cancer doesn’t discriminate. It doesn’t care where you’re from, how you live, or how healthy you try to be. And now, it’s here – and it’s with my mum.”

‘Emotional rollercoaster’

Calum continued: “I’ll be honest, I haven’t cried in years. But this has been an emotional rollercoaster I never expected to be on. We’ve reached a point where we felt it was important to share what we’re going through and, humbly, ask for help.

“My mum has been diagnosed with colon cancer that has spread to her liver. To move forward, we need access to specialist care and professionals who can offer the right treatment. This is incredibly hard for me to say, but financially, I can’t carry this on my own.

“So we’ve created this GoFundMe page to ask for your support. Any contribution, no matter how small, will help us access the specialists, treatment and care my mum needs during this time. We’ll also be sharing updates along the way, and my mum will be posting videos too, when she feels able.

“From the bottom of my heart, thank you for reading, for caring, for sharing and for supporting us in any way you can.”

At the time of writing, the fundraising page has reached almost £15k of its £35k target.

Support authors and subscribe to content

This is premium stuff. Subscribe to read the entire article.