The mystery surrounding Mark Fowler’s sudden return to Walford was finally cleared up in Monday night’s EastEnders (January 26), and it is safe to say the drama is only just getting started as Phil gets involved.

Mark arrived back on the Square to be greeted by his big sister Vicki, but any hope of a warm family reunion quickly fell apart.

Vicki was convinced Mark had come home to support her at her trial against Joel. The Mitchells, however, were not buying it for a second.

Once Vicki was safely out of earshot, Sam and Phil cornered Mark and demanded the truth. And before long, the real reason for his bruised face came out.

Mark admitted he had been working for a dangerous drugs gang, intimidating people who failed to follow orders. With someone now feeding information to the police, Mark revealed his bosses believe he is the snitch. That confession explained his injuries, but it did little to soften Phil.

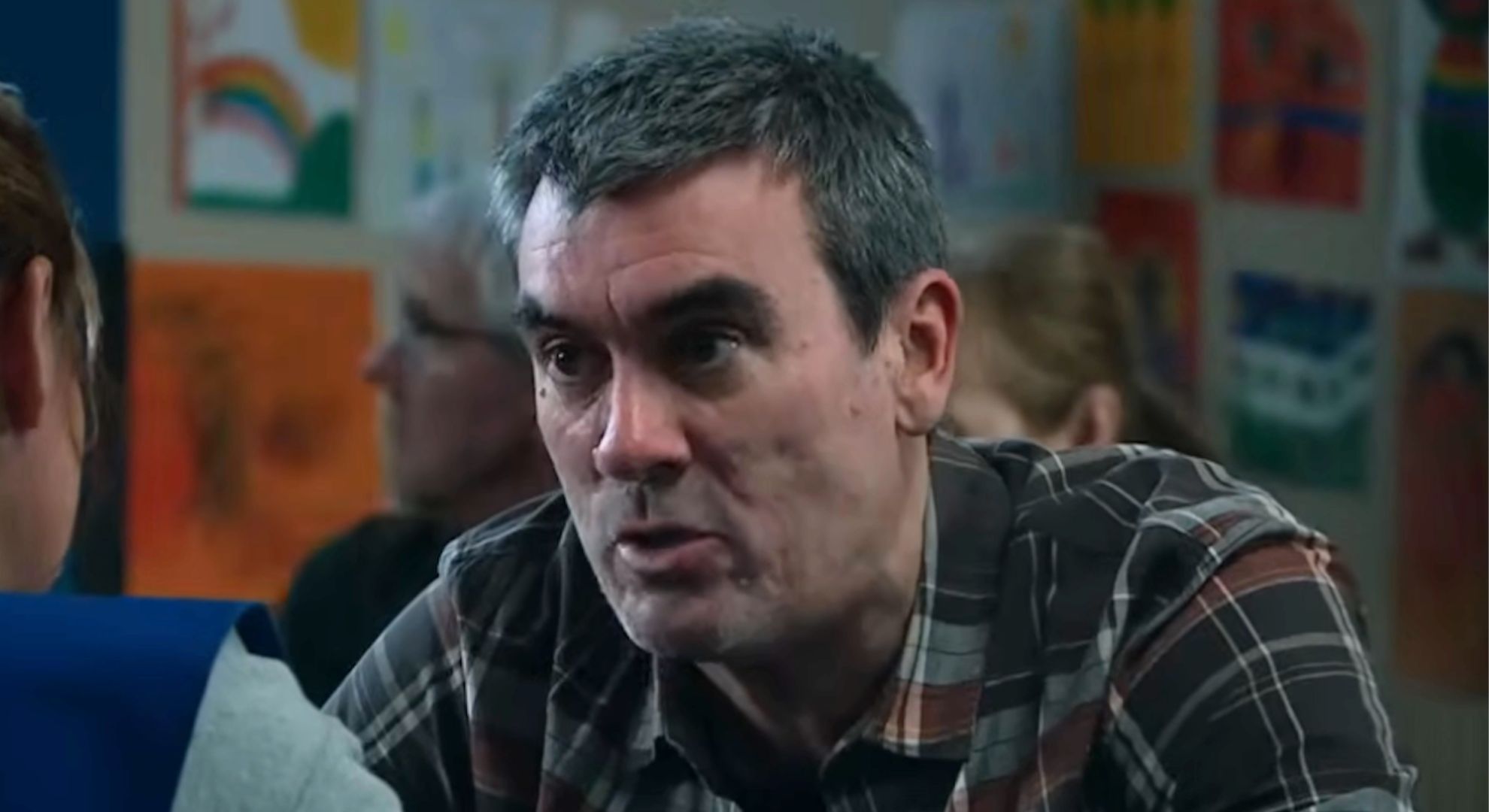

Mark is back in EastEnders, and he is dragging Phil into his drama (Credit: BBC)

EastEnders: Mark showed his true colours to Phil

Despite everything, Phil was determined to stick to his plan to get Nigel on a plane to Portugal that very evening. He bluntly told Mark that he had landed himself in this situation and would need to sort it out alone.

Mark did not take the rejection well. Instead, he decided to act behind Phil’s back.

When Julie returned early from Edinburgh, Mark wasted no time filling her in on Phil’s plan to take Nigel abroad. Julie was left shocked and hurt, realising she had believed they were both on the same page about what was best for Nigel.

Furious, she demanded Nigel’s passport back, packed their bags and moved them into Elaine’s boutique hotel across the Square.

Still unaware that Mark had sabotaged his escape plan, Phil reluctantly agreed to help his nephew after all.

Phil agrees to help Mark in EastEnders, but at what cost? (Credit: BBC

Support authors and subscribe to content

This is premium stuff. Subscribe to read the entire article.